Buy Bitcoin, Sell Bitcoin, and Trade It

Bitcoin (BTCUSD) was developed by a software developer under the pseudonym Satoshi Nakamoto in 2008. It was first made available on the market in 2009 and since then, Bitcoin has gone through a remarkable development, and as of October 2022, it’s priced at almost $20,000. This popular cryptocurrency depends on a feature called a blockchain which is a public register that records all transactions carried out within the Bitcoin network. While this cryptocurrency is only produced and traded electronically, you can still gain exposure and experience trading this crypto through CFDs with registered and licensed, it helps to understand its origins unique features, and what affects its prices.

How Does Bitcoin Work

Unlike fiat currencies, such as euros or US dollars, which have supervision from a central bank like the Federal Reserve, Bitcoin isn’t controlled by a single body. Instead, the cryptocurrency relies on a peer-to-peer network, which is a system composed of the computers of all users participating in the network (also known as nodes). This can be compared, for example, with the networks on which file-sharing systems are based.

Bitcoins are created automatically when the computers of the network users perform complex numerical tasks. This process is known as Bitcoin mining. Mining is planned in such a way that, over time, it becomes more and more difficult for users to mine Bitcoins. Additionally, the total number of Bitcoins that can ever be mined is limited to 21 million units. Because of these limitations, Bitcoin is often considered to be reasonably inflation-proof. It is not possible, for instance, for a central bank to issue new bitcoins, which means that the coins that are already in circulation won’t be devalued. Nonetheless, in recent years as Bitcoin reaches its maturity the evidence shows that its presumable safe-haven status is becoming less plausible as it too can be affected by the broader market movement.

Within the Bitcoin network, transactions are sent quickly and confirmed in a few minutes. Because they are completed on a worldwide network, they are not dependent on their physical location. So it doesn't matter whether someone sends Bitcoins to the nearest city or across the world. Anyone can use Bitcoin because the software can be downloaded and used free of charge.

Furthermore, Cryptocurrencies are secured in an encryption system with two "keys", the public key and the private key. The public key is a unique personal Bitcoin address, which all network participants can view. The private key functions as a type of PIN code that only the respective Bitcoin address owner knows. This key should not be passed on to anyone else and must be kept in a safe place.

Bitcoins are sent to other Bitcoin addresses using seemingly random chains of around 30 characters. While every network participant can see other users’ public addresses, it is not necessarily possible to associate an address with a specific person. It is important to note that a transaction cannot be reversed once it has been verified. After the recipient has accepted the money, it's gone. So, if you accidentally sent it to the wrong address, you usually cannot undo it.

How To Buy Bitcoin?

There is a variety of Bitcoin-buying methods available for those who want to do so.

Crypto exchange platforms let you trade fiat currencies such as euros or US dollars for bitcoins or satoshis, the smallest units of Bitcoin, or (the bitcoin alternative to cents). You may also wish to exchange bitcoins for other cryptocurrencies. Since the exchanges’ fees can vary widely, it helps to compare the providers’ terms in advance. You can also look at the exchange’s regulation and its deposit and withdrawal options.

Investors can also buy and sell Bitcoins on online marketplaces. In contrast to the crypto exchanges, marketplace users have to enter and search for offers or trades independently. There are now also various Bitcoin machines worldwide where users can change Bitcoins or exchange them for another digital currency.

It is also an option to purchase bitcoins from private individuals. However, it should be noted that this route is not associated with a high level of security. Therefore, it is often advisable to stick with reputable platforms for buying and selling cryptocurrencies.

Another way to obtain Bitcoins is the already mentioned Bitcoin Mining. You would need to solve a mathematical problem encoded within the blockchain. Numerous attempts are usually necessary to find a “hash” that consists of the transaction data and the information from the current and previous data blocks. Once a suitable hash is finally found, it can be appended to the earlier blocks as a finished data block.

A Bitcoin miner who has found the correct hash receives a reward in the form of bitcoins. However, mining has become very difficult for individuals because it requires a lot of computing power and correspondingly high power consumption. One alternative to personal mining is a mining pool in which several users bundle their computing power.

Illustrative prices.

Holding Bitcoin and What Is a Bitcoin Wallet?

The most crucial tool for buying and selling Bitcoin is called a “wallet”. A digital wallet works similarly to a bank account, and you can use it to receive, manage and send Bitcoins. Several crypto platforms offer the option of storing bitcoins online. However, it is much safer to transfer purchased coins to your own wallet that you back up regularly.

The buyer copies and pastes the Bitcoin address into his wallet for payment to exchange Bitcoins or use them for purchases. Sometimes, a clickable Bitcoin address or a QR code is given instead, which the user scans with his mobile phone. Bitcoin owners have to keep in mind the risks that come with Bitcoin wallets. This type of digital wallet is susceptible to hacking attempts.

Bitcoin Trading Against USD

Unlike fiat currencies, Bitcoin is run through peer-to-peer technology. This means that there is no Central Bank or other authority to set the value of how much Bitcoin is worth. The value of the cryptocurrency is reflected entirely by how much buyers are willing to pay for Bitcoin, and at what price sellers are willing to part with it.

Because USD is the world’s most widely used currency, it makes sense that the Bitcoin / USD pair (BTC/USD) is also used extensively by traders. This is a good reason to pay attention to the Bitcoin chart for USD to see how the crypto is performing.

Bitcoin charts are one way to see the price history of the cryptocurrency which can be used as part of the decision-making process during trading. There are several different kinds of charts that each offer different benefits to traders.

Trading Bitcoin CFDs with Plus500

Plus500 does not offer Bitcoins for sale. However, if you do not wish to physically own any Bitcoin but you want to trade on the digital currency’s price movements, you can decide to trade bitcoin CFDs. The abbreviation CFD stands for Contract for Difference. With CFDs, the trader does not become the owner of an underlying asset such as Bitcoin. Instead, he or she speculates on the price movement of the underlying asset and can trade on upward and falling crypto prices.

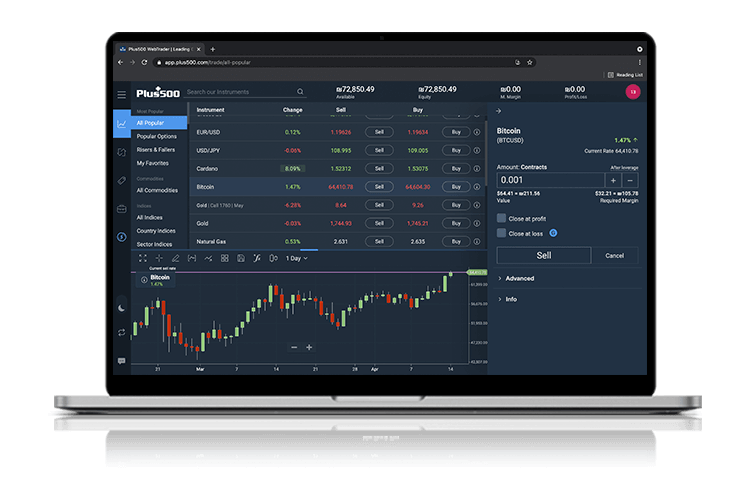

To trade Bitcoin CFDs with Plus500, you can either log in to the platform directly or click the “Start Trading” button from the website to get there. The platform has a search bar where you can type in “Bitcoin”, or you can search for Bitcoin from the instrument list to the left-hand side of the platform. You can also make it more practicable to trade Bitcoin if you add it to your “Favorites”, by clicking on the star in the Bitcoin details section.

After selecting Bitcoin, you will be able to see the conditions of the instrument, including the current Buy and Sell prices offered on the Plus500 platform and the contract expiry date. To open a position, click on the Buy or Sell button next to the relevant price and choose how many units you would like to trade. You can then add a “Close at Profit” or “Close at Loss” to help manage your risk. Your Bitcoin CFD order will appear in the list of active orders in your account.

Underneath is the charting section, where you can choose the display time frame and select the type of chart you wish to view. When you are ready to close a Bitcoin CFD position, click the Close Position button.

Alternatively, if you want to test CFDs trading with Plus500 without committing your capital from the beginning, you can trade through Plus500’s free-of-charge and unlimited Demo Account mode until you feel ready and confident enough to trade CFDs with real money.

Illustrative prices.

Bitcoin Charts

Bitcoin Rate Chart

A Bitcoin rate chart has a list of BTC/USD prices for specific dates. Bitcoin’s first price increase occurred in 2010 when the price for a single coin went from $0.0008 to $0.08, and since then there have been numerous price fluctuations for traders to measure. Traders can use Bitcoin rate charts to see historical rates for the cryptocurrency. This is one way to create forecasts and see historical data and trends.

Bitcoin Live Chart

Because Bitcoin is decentralized, it goes through periods of high volatility. To trade Bitcoin well, it’s important to keep on top of how prices are moving. Many traders keep track of Bitcoin prices in real-time using live Bitcoin charts. This type of chart can also be used for detailed trading analysis.

Conclusion

In conclusion, Bitcoin has a colourful background as the world’s first cryptocurrency. Trading Bitcoin by using CFDs is one way to potentially take advantage of the crypto’s price movements without having to purchase the asset directly. Nevertheless, you should be aware that the value of Bitcoin CFDs is vulnerable to sharp changes due to unexpected events or changes in market sentiments. Therefore, you should ensure that you fully understand the risks before you start trading. In addition, you can refer to Plus500’s Trading Academy which includes FAQs, a free eBook, and free how-to trading video guides to sharpen your trading knowledge and utilise Plus500’s free risk management tools to minimize any potential losses.

Subject to operator availability.